Omni-channel motor insurance at PKO BP

Case study of implementation of insurance sales and service platform

Objective and results

Design challenges

Launching an innovative process of purchasing a package motor insurance for the current Customer of the Bank with the possibility of continuing the interrupted calculation in any sales channel.

The results

The implemented solution enables the entire purchasing process to pass through any sales channel, with the possibility of interruption and continuation from the point of abandonment in other channels.

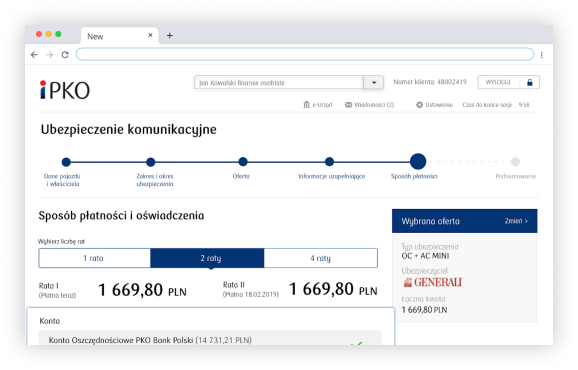

The system, through numerous integrations, automates the process of data acquisition, reducing the work time on the application as much as possible. Selected functionalities which influence the acceleration of work include: automatic downloading of the Client's data from the central file, acquisition of the vehicle data based only on the number of license plates, algorithms of calculating the most advantageous offer of the Client taking into account the result of the needs analysis, integration of the sales path with a wide range of payment methods such as direct debiting of the account, cards or integration with payments "in the Bank's window".

Moreover, the system provides support for the Bank in the process of premium allocation, refunds, commission calculations or automation of renewals.

Implementation process

Planning

In the first stage, the Bank internally developed a preliminary list of several hundred functional and non-functional requirements in accordance with the newly created business, rules functioning in the Bank and requirements of the security department. On the basis of these requirements, a detailed analysis was carried out, which constituted the complete scope of the project decomposed into a multi-stage implementation schedule.

Adjustment of the platform to the requirements

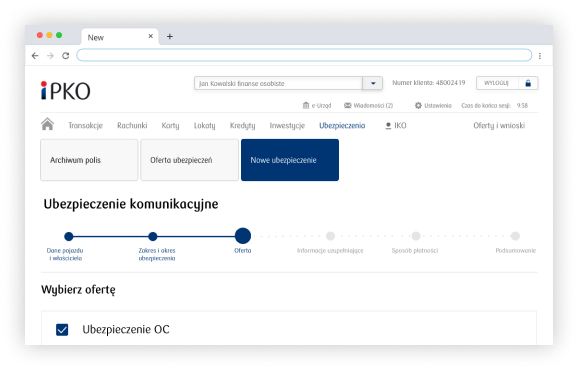

In less than three months, key processes were prepared, including the innovative process of purchasing motor insurance, which allows for the purchase of several risks from different companies in a single sales approach, which ultimately constitutes a uniform contract of the Customer. At the same time, all components supporting the sales path were adjusted to the Bank's Corporate Identity / Brand Book.

Installation and integration with the Bank's environment

Based on the requirements prepared by the Bank, the necessary integrations of the Blue Booster platform with the Bank's systems and external systems of insurance companies were defined. Interfaces of these systems were then connected to the Blue Booster platform and made available for use in the Bank's environments. As a result, in less than seven months, it was possible to prepare, test and implement dedicated sales processes and launch sales through all ground channels.

Development and implementation of subsequent stages

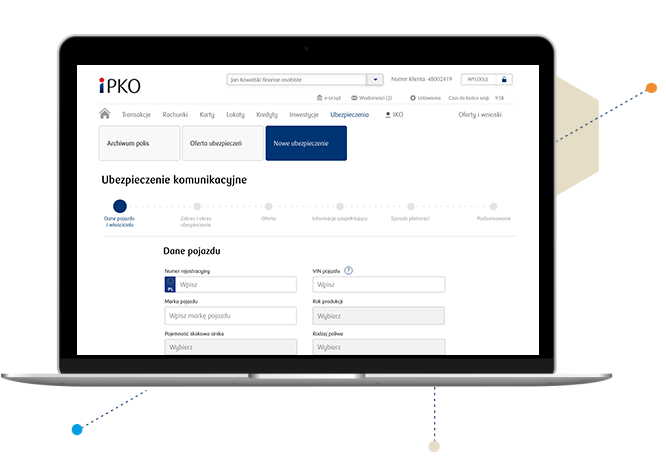

In the following months, the platform was integrated through further dedicated integrations with other sales channels of the Bank. Thanks to this, it became possible to fully handle customer applications as Omnichannel processes, where the customer could, for example, initiate calculations on the mobile application IKO, switch to continue it in the iPKO transactional system, and in case of problems consult the Sales CallCenter or go to the outlet and there close the process with the purchase of the policy.